CKB skyrockets 111% in a week following Upbit listing, hits highest level since June

Nervos Network’s native token, CKB, has surged by over 111% in the last 7 days, driven by its recent listing on the South Korean exchange Upbit.

The jump in price has spotlighted Nervos Network ![]() ckb-8.31%Nervos Network as the top-performing cryptocurrency among the top 100 digital assets by market value and elevated its price from $0.159 to $0.0176 on Sep. 16.

ckb-8.31%Nervos Network as the top-performing cryptocurrency among the top 100 digital assets by market value and elevated its price from $0.159 to $0.0176 on Sep. 16.

This is the highest level the token has been since June 10, with its market capitalization leaping to $729 million, positioning it as the 92nd largest digital asset globally, according to CoinGecko data.

The recent spike in CKB price is largely driven by its listing on the major South Korean exchange, Upbit. The new listing has made it easier for traders to purchase CKB with U.S. dollars, South Korean won, or Tether (USDT), leading to a big jump in demand.

Data from CoinGecko shows a surge in activity from South Korean traders, with the CKB/KRW trading pair alone contributing over $331.6 million in 24-hour volume on Upbit. Binance followed with $134.7 million in trading volume.

The renewed optimism resulted in a 100% leap in its total daily trading volume, currently hovering around $381 million.

Meanwhile, Coinglass data shows that CKB’s daily open interest surged by 13.4% to $116.6 million when writing. This coupled with an increase in trading volume, suggests a spike in investor activity, potentially adding fuel to CKB’s ongoing rally.

Nervos Network is a proof-of-work layer-2 project designed to enhance Bitcoin btc-1.34%Bitcoin by adding programmability and scalability through the implementation of the RGB++ protocol.

CKB price action

As crypto.news reported earlier, CKB’s price surge has also coincided with the convergence of two lines forming a falling wedge pattern, a technical setup that typically signals further upside potential.

It has also broken the upper Bollinger Band, which stands at $0.0153, signaling a wave of upward strength. In addition, the Relative Strength Index is reflecting an overbought condition, sitting at 78, which signifies that buying pressure has been intense.

Historically, an RSI above 70 suggests overbought levels, but this can also accompany continued price rallies, particularly when strong momentum is at play.

Given the current trend, traders should keep an eye on the $0.02 mark, which could serve as the next psychological resistance. A successful breach of this level, combined with strong volume, might push the price toward $0.025 or higher.

However, the overbought RSI does raise the possibility of a correction or consolidation in the near term. In the event of a reversal, the middle Bollinger Band, which lies near $0.0096, could act as a potential support level.

Traders should exercise caution and monitor the momentum, as a pullback to this level could indicate the beginning of a short-term consolidation phase.

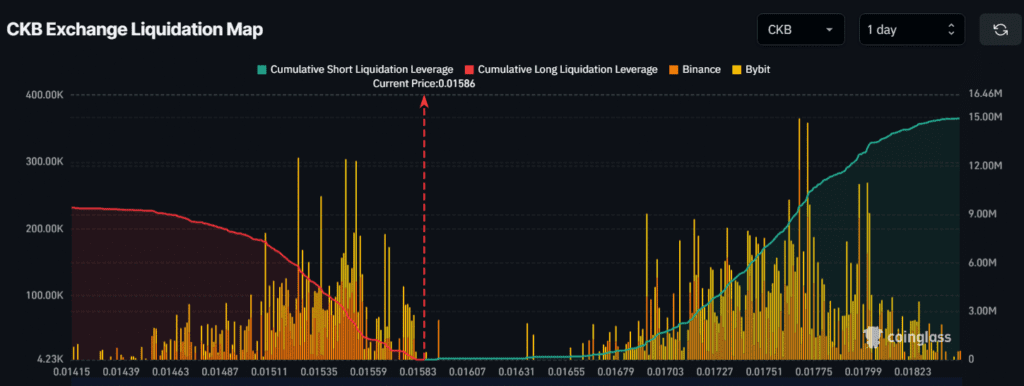

Major liquidation levels

Currently, the critical liquidation thresholds for CKB stand at approximately $0.0152 on the lower side and $0.0176 on the higher side, with a high level of leverage observed among intraday traders at these prices, according to Coinglass.

Should market dynamics shift and the price of CKB fall to $0.0152, it could trigger the liquidation of nearly $5.77 million in long positions. Conversely, if the market sentiment turns positive and the price rises to $0.0176, around $9.5 million in short positions could be liquidated.

At press time, data indicated that bulls were in control, with the potential to trigger liquidations of short positions at higher levels.